Treasuries, CDs, and Munis | March Rates Update

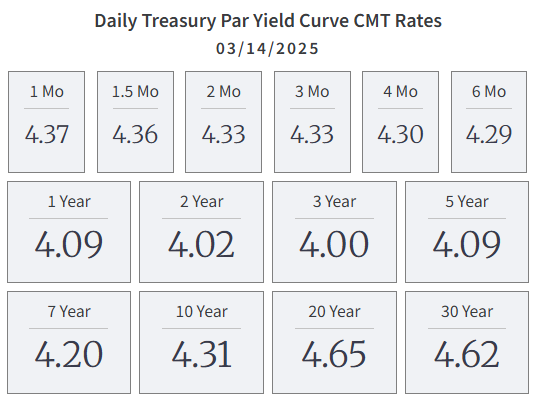

The FOMC meets this week on Tuesday and Wednesday. We do not expect any change to the federal funds rate.

COMMENTARY

Here are a few thoughts on last week’s fiscal policy actions. Congress passed a continuing resolution (CR) spending bill to fund federal government spending through the end of the fiscal year (September 30th), avoiding a government shutdown. The bill did not include an increase or suspension of the debt ceiling. Treasury can use extraordinary measures for a few months, but the debt ceiling will need to be dealt with by summertime. A recent speech by Roberto Perli, NY Fed Manager of the System Open Market Account, made this balance sheet observation:

“Put simply, the longer balance sheet runoff continues while the debt ceiling situation persists, the higher the risk that, upon the resolution of the debt ceiling, reserves could rapidly decline to levels that could result in considerable volatility in money markets. As noted in the minutes of the January 2025 FOMC meeting, various participants thought it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of the debt ceiling situation.”

It appears increasingly likely that the Fed will be slowing down its quantitative tightening (QT) program soon, which shrinks the overall size of the Fed’s balance sheet. We would like to see the Fed alter the QT program to shift its focus toward reducing its mortgage-backed securities (MBS) portfolio rather than its U.S. Treasury holdings.

We do not expect any change to the federal funds rate at this week’s FOMC meeting. The meeting will include an updated Summary of Economic Projections (SEP) published on Wednesday, March 19th.

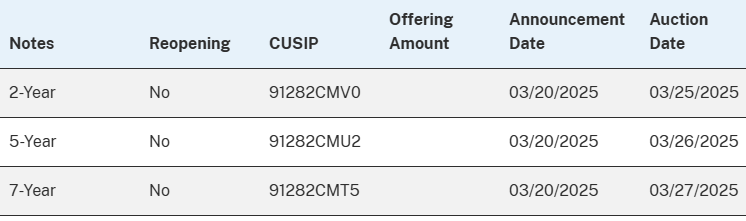

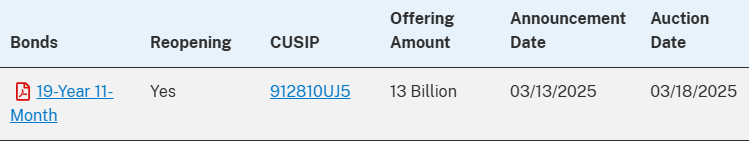

U.S. TREASURY AUCTIONS

U.S. Treasury has a full schedule of upcoming auctions. Investors can purchase treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS

NOTES

BONDS

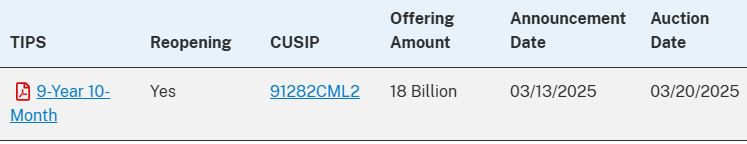

Treasury Inflation-Protected Securities (TIPS)

The current 10-year TIPS yield is 2.00% (+ CPI).

Floating Rate Notes (FRNs)

Floating Rate Notes explained here.

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. Click here to see if a bank is FDIC-insured. You can click on the institution name in the list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

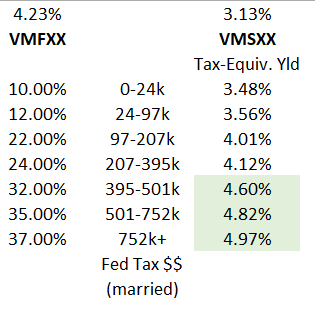

Vanguard Federal Money Market Fund (VMFXX) 4.23%

Vanguard Municipal Money Market Fund (VMSXX) 3.13% (tax-exempt)

Fidelity Money Market Fund (SPRXX) 4.02%

Schwab Value Advantage Money Fund (SWVXX) 4.15%

Below is a tax-equivalent yield comparison of VMFXX versus VMSXX:

CDs

3-months:

Brilliant Bank 4.60%

Bask Bank 4.50%

Ivy Bank 4.35%

6-months:

Mutual One Bank 4.59%

My eBanc 4.55% ($50k minimum)

Total Bank 4.51%

12-months:

Marcus by Goldman Sachs 4.50% (14-month)

Total Bank 4.41%

My eBanc 4.40% ($50k minimum)

NexBank 4.40%

18-months:

My eBanc 4.35% ($50k minimum)

Brilliant Bank 4.35% (15 months)

TAB Bank 4.16%

2-years:

My eBanc 4.25% ($50k minimum)

Total Bank 4.21%

Popular Direct 4.15%

3-years:

Total Bank 4.16%

Popular Direct 4.10%

4-years:

Popular Direct 4.00%

TAB Bank 3.86%

5-years:

Popular Direct 4.15%

Synchrony Bank 4.15%

Total Bank 4.11%

MUNICIPAL BOND AUCTIONS

Below is a list of some of the largest upcoming municipal bond offerings nationwide:

Source: EMMA

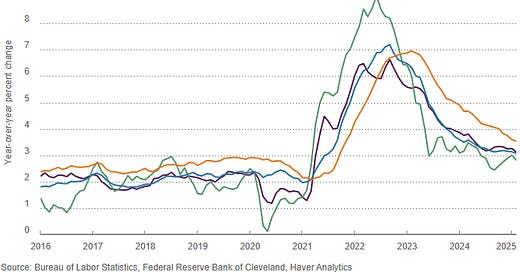

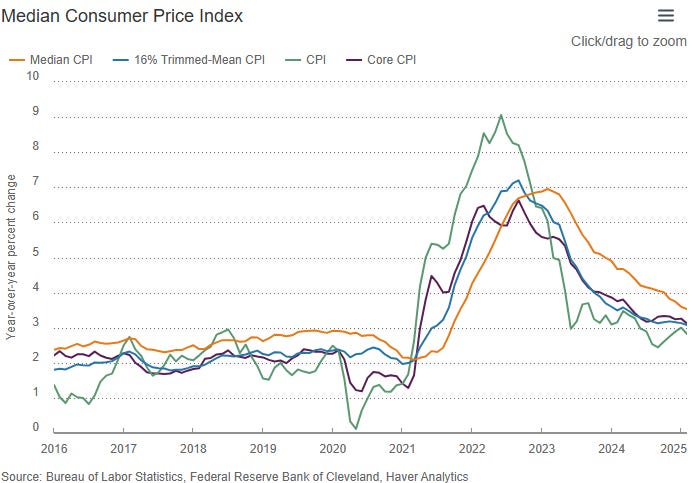

CONSUMER PRICE INDEX (CPI) | JANUARY 2024

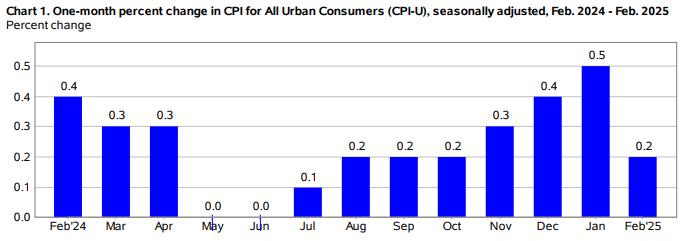

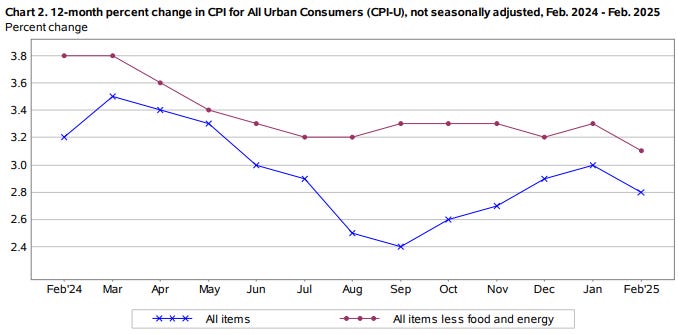

The latest CPI inflation report showed that headline CPI inflation increased 0.2% in February and is up 2.8% year over year. The core CPI, which excludes the volatile food and energy components, rose 0.2% in February and is up 3.1% year over year. These inflation figures remain too high for the FOMC to lower the federal funds rate. We expect no change to the federal funds rate at the upcoming FOMC meeting on March 18th and 19th.

Headline CPI:

+0.2% seasonally adjusted in February, following +0.5% in January

+2.8% year-over-year

Core CPI: (excludes food and energy)

+0.2% seasonally adjusted in February, following +0.4% in January

+3.1% year-over-year

Median and 16% trimmed-mean CPI from Cleveland Fed:

Median +0.3% in February and +3.5% YoY

16% trimmed-mean +0.3% in February and +3.1% YoY

In case you missed it, here is our Model Portfolio Update published earlier this month.