Treasuries, CD Rates, and Muni Auctions

There are only a few CD deals that still offer a 5% APY.

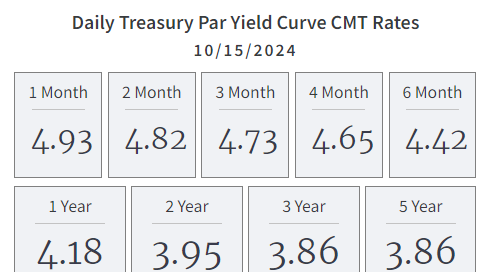

U.S. TREASURY AUCTIONS

U.S. Treasury has a full schedule of upcoming auctions. Investors can purchase treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS

BONDS

Treasury Inflation-Protected Securities (TIPS)

The current 5-year TIPS yield is 1.6% (+ CPI).

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. Click here to see if a bank is FDIC-insured. You can click on the institution name in the list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

Vanguard Municipal Money Market Fund 3.11% (tax-exempt)

CDs

3-months:

Mutual One Bank 5.00%

Total Bank 5.00%

Bank5 Connect 4.75%

6-months:

Bank5 Connect 4.95%

Total Bank 4.85%

LendingClub 4.80%

12-months:

LendingClub 4.70% (10-month)

My eBanc 4.60% ($50k minimum)

The Federal Savings Bank 4.60%

18-months:

Lending Club 4.40%

My eBanc 4.40% ($50k minimum)

The Federal Savings Bank 4.39%

2-years:

The Federal Savings Bank 4.28%

My eBanc 4.25% ($50k minimum)

Lending Club 4.15%

3-years:

Synchrony Bank 4.00%

The Federal Savings Bank 4.00%

My eBanc 3.98% ($50k minimum)

4-years:

Synchrony Bank 4.00%

The Federal Savings Bank 3.90%

BMO Alto Bank 3.90%

5-years:

Synchrony Bank 4.00%

BMO Alto Bank 4.00%

Marcus by Goldman Sachs 3.80%

MUNICIPAL BOND AUCTIONS

Below is a list of some of the largest upcoming municipal bond offerings nationwide:

Source: EMMA, BondLink

NOTES

For readers interested in Series I Savings Bonds, we recently posted our forecast for the upcoming November 1st Series I bond rate adjustment:

“We expect the upcoming November 1st Series I Savings Bond rate to result in a composite rate near 3.00%. The new rate is comprised of a 1.1% fixed rate and a 1.90% inflation adjustment. This new composite rate will be roughly 1.3% lower than the current 4.28% I bond rate, which you can still purchase through the end of October.”